Factors Influencing Dividend Policy: Companies Listed in Sri Lanka

Abstract

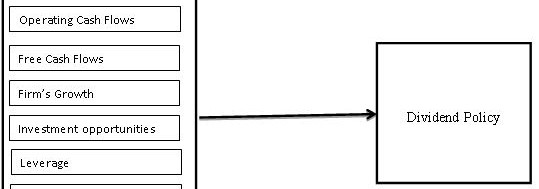

The behavior of the dividend policy is the most debatable issue in the corporate finance. Many researchers try to expose the issue regarding the dividend behavior or dynamics and determinants of dividend policy but still do not have an acceptable description for the observed dividend behavior of firms. Therefore, the present research focused on analysis the factors influencing dividend policy of listed companies in Sri Lanka. The investigation was performed using panel data procedures for a sample of 120 listed companies in Colombo Stock Exchange during 2015 – 2019. Secondary data collected from annual reports published by the Colombo Stock Exchange was regressed to find the influence on dividend policy. The findings revealed that the current earnings, free cash flow and past dividend patterns have significant positive influence on dividend policy on listed companies in Sri Lanka. Operating cash flow has significant negative influence on dividend policy in listed companies in Sri Lanka. Findings will be benefited to the directors, top level managers, shareholders and potential investors for their decision making.

Downloads

References

Adaoglu, C. (2000). Instability in the Dividend Policy of the Istanbul Stock Exchange Corporations: Evidence from an Emerging Market. Managing Market Review, 1, 252-270. Doi: 10.1016/S1566-0141(00)00011-X [Crossref]

Aharony, J., & Swary, I. (1980). Quarterly Dividend and Earnings Announcements and Stockholders' Returns: An Empirical Analysis. Journal of Finance, 35(1), 1-12. Doi:10.1111/j.1540-6261.1980.tb03466.x [Crossref]

Al-Kayed, L. T. (2017). Dividend payout policy of Islamic vs conventional banks: case of Saudi Arabia. International Journal of Islamic and Middle Eastern Finance and Management, 10(1), 117-128. Doi:10.1108/IMEFM-09-2015-0102 [Crossref]

Alli, K.L., Khan, A.Q. & Gabriel, G.R. (1993). Determinants of Corporate Dividend Policy: A Factorial Analysis. The Financial Review, 28, 523- 547. Doi:10.1111/j.1540 6288.1993.tb01361.x [Crossref]

Al-Malkawi, H.A. (2007). Determinants of corporate dividend policy in Jordan: an application of the Tobit model. Journal of Economic and Administrative Sciences, 23 (2), 44-70. Doi: 10.1108/10264116200700007[Crossref]

Al‐Najjar, B. (2011). The inter‐relationship between capital structure and dividend policy: empirical evidence from Jordanian data. International Review of Applied Economics, 25(2), 209-224. Doi:10.1080/02692171.2010.483464 [Crossref]

Al-Najjar, B., & Kilincarslan, E. (2016). The effect of ownership structure on dividend policy: evidence from Turkey. Corporate Governance: The international journal of business in society, 16(1), 135-161. Doi: 10.1108/CG-09-2015-0129[Crossref]

Anup, A. & Narayanan, J. (1994). The Dividend Policies of All-Equity Firms: A Direct Test of the Free Cash Flow Theory. Managerial and Decision Economics, 15(2), 139-148. Doi:10.1002/mde.4090150206[Crossref]

Arko, A. C., Abor, J., Adjasi, C. K., & Amidu, M. (2014). What influence dividend decisions of firms in Sub-Saharan African?. Journal of Accounting in Emerging Economies, 4(1), 57-78. Doi:10.1108/JAEE-12-2011-0053 [Crossref]

Baker, H.K. & Powell, G.E. (1999). Dividend policy issues in regulated and unregulated firms: a managerial perspective. Managerial Finance, 25(6), 1 – 20. Doi:10.1108/03074359910765975 [Crossref]

Barclay, M. J., Clifford, W.S., & Ross, L.W. (1995). The Determinants of Corporate Leverage and Dividend Policies. Journal of Applied Corporate Finance, 07, 4-19. Doi:10.1111/j.1745-6622.1995.tb00259.x [Crossref]

Basiddiq, H., & Hussainey, K. (2012). Does asymmetric information drive UK dividends propensity? Journal of Applied Accounting Research.Doi:10.1108/09675421211281344 [Crossref]

Bhattacharya, S. (1979). Imperfect information, dividend policy, and ‘the bird in the hand’ fallacy. Bell Journal of Economics, 10 (1), 259-270. Doi:10.2307/3003330 [Crossref]

Black, F. (1976). The dividend puzzle. Journal of Portfolio Management, 2(2), 5-8. Doi:10.3905/jpm.1976.408558[Crossref]

Bulan, L.T. & Hull, T. (2013). The impact of technical defaults on dividend policy. Journal of Banking and Finance, 37(3), 814-823. Doi:10.1016/j.jbankfin.2012.10.014[Crossref]

Chang, R. P., & Rhee, S. G. (1990). The impact of personal taxes on corporate dividend policy and capital structure decisions. Financial management, 19(2), 21-31. Doi:10.2307/3665631 [Crossref]

Charitou, A. (2000). The impact of losses and cash lows of dividends: evidence of Japan’, ABACUS. 36(2), 198-225. Doi:10.2139/ssrn.252063 [Crossref]

DeAngelo, H., & DeAngelo, L. (2006). The irrelevance of the MM dividend irrelevance theorem. Journal of financial economics, 79(2), 293-315. Doi:10.1016/j.jfineco.2005.03.003 [Crossref]

DeAngelo, H., DeAngelo, L., & Skinner, D. J. (1996). Reversal of fortune dividend signaling and the disappearance of sustained earnings growth. Journal of financial Economics, 40(3), 341-371. Doi:10.1016/0304-405X(95)00850-E [Crossref]

Easterbrook, F.H. (1984). Two agency-cost explanations of dividends. American Economic Review, 74(4), 650-659. [Article]

Fama, E. & French, K. (2001). Disappearing Dividends: Changing Firm Characteristics or Lower Propensity to Pay? Journal of Financial Economics, 60(1), 3-43. Doi: 10.1016/S0304-405X(01)00038-1 [Crossref]

Gill, A., Biger, N., & Tibrewala, R. (2010). Determinants of dividend payout ratios: evidence from United States. The Open Business Journal, 3, 8-14. Doi: 10.2174/1874915101003010008 [Crossref]

Gordon, M. (1962). The Savings Investment and Valuation of a Corporation. The Review of Economics and Statistics, 44(1), 37-51. Doi:10.2307/1926621 [Crossref] [Article]

Gordon, M. J. (1959). Dividends, earnings, and stock prices. The review of economics and statistics, 41(2), 99-105. Doi:10.2307/1927792 [Crossref][Article]

HAUSMAN, J. A. (1978). Specification Tests in Econometrics. Econometrica, 46, 1251-1271. Doi: 10.2307/1913827 [Crossref] [Article]

Husain, U., & Javed, S. (2019). Stock Price Movement And Volatility In Muscat Security Market ( MSM ). International Journal of Research - Granthaalayah, 7(February), 68–84. Doi: 10.5281/zenodo.2580535 [Crossref]

Malik, A., Khan, N., Faisal, S., Javed, S., & Faridi, M. rashad. (2020). An Investigation On Leadership Styles For The Business Productivity And Sustainability Of Small Medium Enterprises (SME’S). International Journal of Entrepreneurship, 24(5), 1–10. [Article]

Holder, M. E., Langrehr, F. W., & Hexter, J. L. (1998). Dividend policy determinants: An investigation of the influences of stakeholder theory. Financial management, 27(3), 73-82. Doi: 10.2307/3666276 [Crossref] [Article]

Javed, S., Atallah, B., Aldalaien, E., & Husain, U. (2019). Performance of Venture Capital Firms in UK : Quantitative Research Approach of 20 UK Venture Capitals. Middle-East Journal of Scientific Research, 27(5), 432–438. Doi: 10.5829/idosi.mejsr.2019.432.438 [Crossref]

Javed, S., Husain, U., & Ali, S. (2020). Relevancy of Investment Decisions And Consumption With Asset Pricing : GMM And CCAPM Model Approach. International Journal of Management, 11(8), 10–17. Doi:10.34218/IJM.11.8.2020.002 [Crossref]

Javed, S., & Khan, A. A. (2017). Analysing Parsimonious Model of OL and OE Using SEM Technique. International Journal of Applied Business and Economic Research, 15(22), 685–712. [Crossref]

Khan, A. A., & Javed, S. (2017). A study of volatility behaviour of S & P BSE BANKEX return in India : A pragmatic approach using GARCH model. International Journal of Advanced and Applied Sciences, 4(4), 127–132. Doi: 10.21833/ijaas.2017.04.018 [Crossref]

Jasim, A.A., Hameeda, A.H. (2011). Corporate dividends decisions: evidence from Saudi Arabia. The Journal of Risk Finance, 12(1), 41 – 56. Doi:10.1108/15265941111100067 [Crossref]

Jean, P.D., Thomas, M., Jean, C.R. & Stephani, V. (2011). Free Cash Flow, Issuance Costs, and Stock Prices. The Journal of Finance, 66(5), 1501-1544. Doi:10.1111/j.1540-6261.2011.01680.x [Crossref]

Jensen, G., Solberg, D. & Zorn, T. (1992). Simultaneous determination of insider ownership, debt, and dividend policies. Journal of Financial and Quantitative Analysis, 27(2), 274-263. Doi:https://doi.org/10.2307/2331370 [Crossref] [Article]

Jensen, M.C. & Meckling, W. (1976). Theory of the firm: Managerial behavior, agency costs, and capital structure. Journal of Financial Economics, 3(1), 305-360. Doi:10.1016/0304-405X(76)90026-X [Crossref]

Jensen, M.C. (1986). Agency costs of free cash flow, corporate finance, and takeovers. The American Economic Review, 76(2), 323-329. https://www.jstor.org/stable/1818789 [Article]

Kadioglu, E., & Yilmaz, E. A. (2017). Is the free cash flow hypothesis valid in Turkey? Borsa Istanbul Review, 17(2), 111-116. Doi: 10.1016/j.bir.2016.12.001 [Crossref]

Kowalewski, O., Stetsyuk, I. and Talavera, O. (2007), Corporate Governance and Dividend Policy in Poland, German Institute for Economic Research. [Article]

Lintner, J. (1956) Distribution of incomes of corporations among dividends, retained earnings and taxes. American Economic Review, 46(2), 97-113. [Article]

Lintner, J. (1962). Dividends, earnings, leverage, stock prices and the supply of capital to corporations. The review of Economics and Statistics, 44, 243-269. Doi:10.2307/1926397 [Crossref] [Article]

Loyd, W. P., Jahera, J. S., & Page, D. E. (1985). Agency costs and dividend payout ratios. Quarterly Journal of Business and Economics, 24, 19-29.[Article]

Mehrani, S., Moradi, M. & Eskandar, H. (2011). Ownership structure and dividend policy: evidence from Iran. African Journal of Business Management, 5(17), 7516-7525.DOI: 10.5897/AJBM11.468 [Crossref] [Article]

Miller, M., Modigliani, F. (1961). Dividend policy, growth and the valuation of shares. Journal of Business, 34, 411-433. [Article]

Miller, M., Modigliani, F., (1958). The Cost of Capital, Corporate Finance and the Theory of Investment. American Economic Review, 48, 261-297. [Article]

Miller, M.H. & Kevin, R. (1985). Dividend Policy under Asymmetric Information. Journal of Finance, 40, 1031-1051. Doi:10.1111/j.1540-6261.1985.tb02362.x [Crossref]

Pandey, I.M. (2001). Corporate Dividend Policy and Behaviour: The Malaysian Experience’, Working Paper No. 2001-11-01. (Indian Institute of Management Ahmedabad). Doi: 10.2139/ssrn.299912 [Crossref]

Perretti, G. F., Allen, M. T., & Weeks, H. S. (2013). Determinants of dividend policies for ADR firms. Managerial Finance, 39(12), 1155-1168. Doi: 10.1108/MF-04-2013-0075 [Crossref]

Pruitt, S.W. & Gitman, L.J. (1991) The interactions between the investment, financing, and dividend decisions of major US firms. Financial Review, 26(3), 409-430. Doi:10.1111/j.1540-6288.1991.tb00388.x [Crossref]

Ramli, N. M. (2010). Ownership structure and dividend policy: Evidence from Malaysian companies. International Review of Business Research Papers, 6(1), 170-180. [Article]

Redding, L. S. (1997). Firm size and dividend payouts. Journal of financial intermediation, 6(3), 224-248. Doi:10.1006/jfin.1997.0221 [Crossref]

Rozeff, M.S. (1982). Growth, Beta and Agency Costs as Determinants of Dividend Payout Ratios. The Journal of Financial Research, 5(3), 249-259. Doi:10.1111/j.1475-6803.1982.tb00299.x [Crossref]

Rubinstein, M. (1976). The Irrelevancy of Dividend Policy in an Arrow-Debreu Economy. The Journal of Finance, 31(4), 1229-1230. Doi:10.2307/2326286 [Crossref] [Article]

Setiawan, D., Bandi, B., Phua, L. K., & Trinugroho, I. (2016). Ownership structure and dividend policy in Indonesia. Journal of Asia Business Studies, 10(3), 230-252. Doi: 10.1108/JABS-05-2015-0053 [Crossref]

Walter, J.E. (1963). Dividend Policy: Its influence on the value of the enterprise. The Journal of Finance, 18(2), 280-291. Doi:10.2307/2977909 [Crossref] [Article]

Yusof, Y., & Ismail, S. (2016). Determinants of dividend policy of public listed companies in Malaysia. Review of International Business and Strategy, 26(1), 88-99. Doi:10.1108/RIBS-02-2014-0030 [Crossref]

Copyright (c) 2021 INTERNATIONAL JOURNAL OF ECONOMICS, BUSINESS AND HUMAN BEHAVIOUR

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.