Real Estate Futures and Derivative Markets in India

Scope and Challenges

Abstract

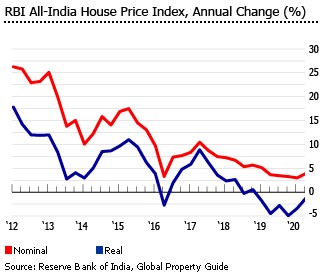

In this paper, we try to explain how Real Estate Futures and the Derivatives market would be important for our Indian Economy. We aim to come up with the scope of Real Estate Futures and Derivative Markets in India and also take into consideration the challenges that this would face in the Indian Markets. To come up with these things we conducted a literature review, in which we went through Research Papers written before the commencement of this market regarding the basics of Real Estate futures and derivatives market in other countries as well as papers that were written after the market was implemented. The Real Estate Futures and Derivatives market will also provide liquidity to investors who want to diversify their portfolio and even to those who want to hedge their losses. Liquidity being an important factor in any futures and derivatives market, it is important to have investors who possess the right information and knowledge as to how the market functions. The Indian Real Estate Market was examined and the advantages of Real Estate Futures and Derivatives markets outweigh the challenges.

Downloads

References

Albashabsheh, A., Alhroob, M., Irbihat, B., & Javed, S. (2018). Impact Of Accounting Information System In Reducing Costing In Jordanian Banks. International Journal of Research Granthaalayah, 6(7), 210–215. https://doi.org/10.5281/zenodo.1336672

Alhroob, M., Irbihat, B., Albashabsheh, A., & Javed, S. (2017). Does Corporate Governance Create Volatility in Performance ? International Journal of Informative & Futuristic Research, 4(7), 6859–6866. Retrieved from http://www.ijifr.com/pdfsave/01-04-2017495IJIFR-V4-E7-075.pdf

Aye, G. C., Goswami, S., & Gupta, R. (2012). Metropolitan House Prices in India : Do They Converge ? University of Pretoria Department of Economics Working Paper Series Metropolitan House Prices in India : Do they Converge ? Goodness C . Aye University of Pretoria Samrat Goswami Rangan Gupta Univers. January.

Fabozzi, F. J., Shiller, R. J., & Tunaru, R. S. (2009). Hedging real estate risk. Journal of Portfolio Management, 35(5). https://doi.org/10.3905/JPM.2009.35.5.092

Fabozzi, F. J., Shiller, R. J., & Tunaru, R. S. (2020). A 30-Year perspective on property derivatives: What can be done to tame property price risk? Journal of Economic Perspectives, 34(4), 121–145. https://doi.org/10.1257/JEP.34.4.121

Husain, U., & Javed, S. (2019a). Impact of Climate Change on Agriculture and Indian Economy : A Quantitative Research Perspective from 1980 to 2016. Industrial Engineering & Management, 8(2), 2–5. Retrieved from https://www.hilarispublisher.com/open-access/impact-of-climate-change-on-agriculture-and-indian-economy-a-quantitative-research-perspective-from-1980-to-2016.pdf

Husain, U., & Javed, S. (2019b). Stock Price Movement And Volatility In Muscat Security Market ( MSM ). International Journal of Research - Granthaalayah, 7(February), 68–84. https://doi.org/10.5281/zenodo.2580535

Javed, S. (2017). Unified Theory Of Acceptance And Use Of Technology (UTAUT) Model-Mobile Banking. Journal of Internet Banking and Commerce, 22(3), 1–20. Retrieved from https://www.icommercecentral.com/open-access/unified-theory-of-acceptance-and-use-of-technology-utaut-modelmobile-banking.php?aid=86597

Javed, S. (2018). Does Organisation Behaviour Affect Performance Of Auditing Firms? International Journal of Engineering Technologies and Management Research, 5(1), 90–98. https://doi.org/10.5281/zenodo.1171842

Javed, S., Aldalaien, B. A., Husain, U., & Khan, M. S. (2019). Impact of Federal Funds Rate on Monthly Stocks Return of United States of America. International Journal of Business and Management, 14(9), 105–113. https://doi.org/10.5539/ijbm.v14n9p105

Javed, S., Atallah, B., Aldalaien, E., & Husain, U. (2019). Performance of Venture Capital Firms in UK : Quantitative Research Approach of 20 UK Venture Capitals. Middle-East Journal of Scientific Research, 27(5), 432–438. https://doi.org/10.5829/idosi.mejsr.2019.432.438

Javed, S., & Azhar, A. (2017). Forecasting Employee Turnover for Human Resource Based on Time Series Analysis. International Journal Of Economics Research, 14(16), 445–456. Retrieved from https://serialsjournals.com/abstract/46037_ch_37_f_-_forecasting.pdf

Javed, S., Husain, U., & Ali, S. (2020). Relevancy of Investment Decisions And Consumption With Asset Pricing : GMM And CCAPM Model Approach. International Journal of Management, 11(8), 10–17. https://doi.org/10.34218/IJM.11.8.2020.002

Javed, S., & Khan, A. A. (2017). Analysing Parsimonious Model of OL and OE Using SEM Technique. International Journal of Applied Business and Economic Research, 15(22), 685–712. Retrieved from https://serialsjournals.com/abstract/53799_sarfarz_and_azeem.pdf

Kumar, B., Chawla, N., & Mohanty, B. (2018). Reform in the Indian real estate sector: an analysis. International Journal of Law and Management, 60(1), 55–68. https://doi.org/10.1108/IJLMA-10-2016-0093

Khan, A. A., & Javed, S. (2017). Accounting of post merger financial performance of Punjab National Bank (PNB) and Nedungadi Bank. International Journal of Mechanical Engineering and Technology, 8(11), 1043–1062. Retrieved from http://www.iaeme.com/MasterAdmin/Journal_uploads/IJMET/VOLUME_8_ISSUE_11/IJMET_08_11_107.pdf

Khan, A., Baseer, S., & Javed, S. (2017). Perception of students on usage of mobile data by K-mean clustering algorithm. International Journal of Advanced and Applied Sciences, 4(2), 17–21. https://doi.org/https://doi.org/10.21833/ijaas.2017.02.003

Putatunda, S. (2019). PropTech for proactive pricing of houses in classified advertisements in the Indian real estate market. ArXiv. https://doi.org/10.5281/zenodo.3401788

Rouanet, H., & Halbert, L. (2014). Leveraging finance capital: Urban change and self-empowerment of real estate developers in India. Urban Studies, 53(7), 1401–1423. https://doi.org/10.1177/0042098015585917

Rutskiy, V., Javed, S., Azizam, S. H., Chudopal, N., Zhigalov, K., Kuzmich, R., & Pupkov, A. (2020). The Price Determinants of Bitcoin as a New Digital Form of Money. (R. Silhavy, P. Silhavy, & Z. Prokopova, Eds.). Springer International Publishing. https://doi.org/10.1007/978-3-030-63322-6

Sarma, M., Saha, P., & Jayakumar, N. (2017). Asset Inequality in India: Going from Bad to Worse. Social Scientist, 45(3/4), 53–67. http://www.jstor.org/stable/26380345

Shiller, R. J., Blitzer, D., Hartigan, J., Loebs, T., Reiss, J., Rive, S., Ullal, A., & Walny, R. (2008). Nber Working Paper Series Derivatives Markets for Home Prices. http://www.nber.org/papers/w13962

Copyright (c) 2021 INTERNATIONAL JOURNAL OF ECONOMICS, BUSINESS AND HUMAN BEHAVIOUR

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.