Challenges for Financial Inclusion Through Microfinancing

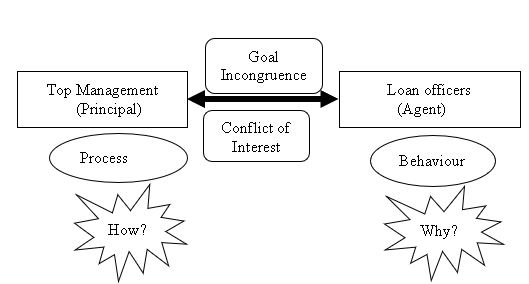

The Goal Incongruence Between Top Management and the Loan Officers

Abstract

The drift of mission from social orientation to commercial orientation has created issues at the firm level as well as the social level. Foci of the study to explore the reasons for emerging issues in the microfinance field. Mainly through a qualitative approach and from the agency theory standpoint, the study attempt to answer why and how goal incongruences occurred between top management and loan officers. The thematic analysis results reveal that institutional process, agency variables and cost, and personal reasons of loan officers, including self-interest, have contributed to the goal incongruence. Notably, the inability to verify the loan officer’s behaviour and manage bonding cost and monitoring cost at an optimal level due to weaknesses of the internal process can be recognised as the causes for the goal incongruence. In addition, theoretical contribution, implications, and limitation of the research are also considered and discussed.

Downloads

References

Afroze, T., Rahman, S. T., & Yousuf, S. (2014). Multiple borrowing through microcredit and its impact on loan repayment: study in Bangladesh. Research Journal of Finance and Accounting, 5(21), 107-119.

Aghion, B. A., & Morduch, J. (2005). The economies of microfinance. London,England: The MIT Press, Cambridge, Massachusetts, London, England.

Anand. (2008). High cost of finance in microcredit business in Andhra Pradesh (India): problems and possible solutions. The ICFAI Journal of Management Research, VII(4), 41-62.

Armendáriz, B., & Morduch, J. (2010). The Economics of Microfinance. London: MIT Press.

Babajide, A. A., Taiwo, J. N., & Adetiloye, K. A. (2017). A comparative analysis of the practice and performance of microfinance institutions in Nigeria. International Journal of Social Economics, 44(11), 1522-1538. doi:https://doi.org/10.1108/IJSE-01-2016-0007

Barney, J. B., & Hesterly, W. (1996). Organisational economics: understanding the relationship between organisations and economic analysis. Handbook of organisation studies, 115-147.

Central Bank of Sri Lanka. (2020, 30 March). Licensed Microfinance Companies. Retrieved from https://www.cbsl.gov.lk/en/authorized-financial-institutions/licensed-microfinance-companies

DailyFT. (2017, September 13). Retrieved from (http://www.ft.lk/financial-services/Impact-of-microfinance-on-Sri-Lanka-s-economic-drive/42-639452)

Dixon, R., Ritchie, J., & Siwale, J. (2006). Loan officers and loan ‘delinquency’ in microfinance: a Zambian case. Durham Business School. Durham City, United Kingdom: Durham University. Retrieved from www.sciencedirect.com

Edward, P., & Olsen, W. (2006). Paradigms and reality in micro-finance: the Indian case. Perspectives on Global Development & Technology, 5(1-2).

Eisenhardt, K. (1989). Agency theory: an assessment and review. Academy of Management Review , 14(1), 57-74.

Goetz, A. (2001). Women development workers: Implementing rural credit programmes in Bangladesh. New Delhi: Sage Publications.

Hermes, N., & Lensink, R. (2007, February 10-16). Impact of microfinance: a critical survey. Economic and Political Weekly, 42(6), 462-465.

Hochschild, A. R. (1983). The managed heart: Commercialisation of human feeling. Berkeley, London: University of California Press.

Holtman, M., & Grammling, M. (2005). A Toolkit for designing and Implementing Staff Incentives Schemes. Microfinance Network and CGAP.

Hudon, M., & Sandberg, J. (2013, October). The ethical crisis in microfinance: issues, findings, and implications. Business Ethics Quarterly, 23(4), 561-589.

Jensen, M., & Meckling, W. (1976). Rheory of the firm: managerial behaviour, agency costs, and ownership structure. Journal of Financial Economics, 3, 305-360.

Karunaratna, A. R., & Johnson, L. W. (2015). Management of exporter-overseas channel intermediary relationships. International Journal of Business and Social Research, 5(1), 33-46.

Kathleen, M. E. (1989). Agency theory: an assessment and review. The Academy of Management Review , 14(1), 57-74. Retrieved from http://www.jstor.org/stable/258191

Kivisto, J. (2008). An assessment of agency theory as a framework for the government–university relationship. Journal of Higher Education Policy and Management, 30(4), 339-350. doi:http://dx.doi.org/10.1080/13600800802383018

Koveos, P., & Randhawa, D. (2004). Financial services for the poor: assessing microfinance institutions. Managerial Finance, 30(9), 70-95.

Labie, M. (2001). Corporate governance in microfinance organisations: a long and widing road. Management Decision, 39(4), 296-302. doi:https://doi.org/10.1108/00251740110391466

Ledgerwood, J., & White, V. (2006). Transforming Microfinance Institutions: Providing Full Financial Services to the Poor. Washington: The World Bank.

Loughry, M. L., & Elms, H. (2006). An agency theory investigation of medical contractors versus member physicians. Journal of Managerial Issues, 18(4), 547-569. Retrieved from http://www.jstor.org/stable/40604558

Mayoux, L. (2000). Micro-finance and the empowerment of women - a review of the key issues. Retrieved from www.ilo.org/public/emglish/employment/finance/papers/mayoux.htm

Moe, T. M. (1984). The new economics of organisation. American Journal of Political Science, 28(4), 739-777.

Mpogle, H., Mwaungulu, I., Mlasu, S., & Lunawa, G. (2012, March). Multiple borrowing and loan repayment: a study of microfinance clients at Iringa, Tanzania. Global Journal of Management and Business Research, 12(4).

Mumtaz, S. (2000). Targeting women in microfinance schemes: objectives and outcomes. THe Pakistan Development Review, 39(4), 877-890.

Mwenda, K. K., & Muuka, G. N. (2004). Towards best practices for microfinance institutional engagement in African rural areas selected cases and agenda for action. International Journal of Social Economics, 31(1/2), 143-158. Retrieved from http://dx.doi.org/10.1108/03068290410515475

Nadler, D. A., & Tushman, M. L. (1992). Designing organisations that have good fit: A framework for understanding new architectures. Organisational architecture: Designs for changing organisations. , San Francisco, CA: Jossey-Bass. Voluntas: International Journal of Voluntary and Nonprofit Organisations, 26(4), 1100-1121.

Nishtar, G. (2001). Development of Micro Finance in Pakistan. Economic Review(5).

Oxfam. (1997). Poor country debt relief: false dawn or new hope for poverty reduction. Oxfam.

Ortolani, M. (2006). Monitoring the Microfinance Processes Microfinance. London.: Palgrave Macmillan.

Padama, K. (2012). Microfinance and its risk management practices in India: A conceptual study. Synergy, X(1), 13-24.

Panda, B., & Leepsa, N. M. (2017). Agency theory: review of theory and evidence on problems and perspectives. Indian Journal of Corporate Governance, 10(1), 74-95. doi:DOI: 10.1177/0974686217701467

Panda, S., Panda , B. K., & Das, A. P. (2013). Microfinance in India. IJABER, 11(2), 355-374.

Sarker, D. (2013). Pressure on loan officers in microfinance institutions: an ethical perspective. Journal of Economics and Sustainable Development, 4(12), 84-88.

Senanayake, S. P. (2002). An overview of the Micro fincne sector in Sri Lanka. Savings and Development, 26(2), 197-222. Retrieved from http://www.jstor.org/stable/25830794

Shankar, S., & Asher, M. G. (2010). Regulating microfinance: a suggested framework. Ecinomic and Political Weekly, 45(1), 15-18. Retrieved from http://www.jstor.org/stable/25663961

Tavanti, M. (2013). Before microfinance: the social value of microsavings in vincentian poverty reduction. The 17th Annual International Vincentian Business Ethics Conference (2010), 112, pp. 697-706.

The Ethical Crisis in Microfinance: Issues, Findings, and Implications. (n.d.).

Tilakaratna, G., & Hulme, D. (2015). Microfinance and Multiple Borrowing in Sri Lanka: Another Microcredit Bubble in South Asia? South Asia Economic Journal, 16(1), 46–63. https://doi.org/10.1177/1391561415575127

Tisdell, C., & Ahmad, S. (2018). Microfinance: economics and ethics . International Journal of Ethics and Systems, 34(3), 372-392.

Williamson, O. E. (1985). The economic institutions of capitalism. Journal of Finance, 43(3), 567-591.

Yaron, Jacob, Benjamin, M. P., & Piprek, G. L. (1997). Rural finance: issues, design and best practices. Washington, DC: World Bank.

Yunus, M. (2007) Banker To The Poor: Micro-Lending and the Battle Against World Poverty. Blackstone Audio Inc.

Copyright (c) 2021 INTERNATIONAL JOURNAL OF ECONOMICS, BUSINESS AND HUMAN BEHAVIOUR

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.